Gin’s revival in popularity has been driven by many of the same factors that were important in gin’s earlier history – the role of marketing/brands, the impact of legislation, developments in flavours and the link to cocktails and fashionability. Four events have been particularly important.

Marketing innovations by IDV led the way. In 1988, IDV replaced Bombay Dry with Bombay Sapphire and based its marketing on the iconic blue bottle and the choice of botanicals. Bombay Sapphire, owned by Bacardi-Martini since 1997, has seen steady growth and is now the world’s fourth largest gin brand.[1] In 1991, IDV reduced the strength of Gordon’s from 40% to 37.5% abv, holding the retail price and investing the excise duty saved in UK marketing, helping Gordon’s and later the overall gin category to return to growth.[2]

The author of this four-part essay is Andrew de Csillery. The essay was written in autumn 2015 as part of the studies and examination for a wine and spirits qualification. The views expressed and the conclusions reached are those of the author alone.

The essay is made up of four parts:

- Introduction and the History of Gin from the Middle Ages to 1985

- Production of Gin, how process variations result in different flavours

- The revival of Gin over the past 30 years

- Conclusions and Commentary, how the category and market may develop over the next 10 years (including appendix and literature list)

In 1989, the so-called “Beer Orders” broke the control brewers had on the UK pub industry, allowing new bar styles to flourish. The Atlantic Bar & Grill reopened in 1994 and was at the forefront as London led the way in rediscovering cocktails, followed by New York.[3] Many of the gin-based classic cocktails were rediscovered and reimagined.[4]

The first few years of the 21st century saw the launch of super-premium brands such as Tanqueray No. Ten (in 2000) and Hendrick’s (in 2000 in the US and 2003 in the UK). These brands were positioned as super-premium products and saw significant innovation in terms of flavour profile, No. Ten with camomile flowers and fresh limes in the botanical mixture, Hendrick’s with cucumber and rose petal essences added after distillation. Supported by stylish, quirky, distinctive marketing, iconic packaging and a focus on the on-trade to drive trial, Hendrick’s has probably been the most successful launch,[5] reaching global sales of 601,600 9-litre cases in 2014.[6]

In 2008-2010, two longstanding UK laws that had stood in the way of a craft spirits renaissance were repealed. One required that pot stills should have a minimum size of 18HL, the other that brewers could not also be distillers on the same site.[7] Their repeal opened the floodgates for an explosion of new micro-distilleries. Between 2010 and 2014, 73 spirit distilleries opened, 56 in 2013 and 2014 alone. Over the same period, the number of UK gin brands increased from 31 to 73.[8]

It still took time for the sales decline in the UK to be reversed, as shown below, with 2001 marking the low point:[9]

However, the recent growth of the UK gin industry has been marked. Sales value grew by 11.3% (2013-2014) and 19.8% (2012-2014).[10] Over the past five years, gin has outperformed the overall UK spirits market in both volume and value growth:[11]

| UK Sales | 2009 | 2014 | CAGR |

|---|---|---|---|

| Gin (000L) | 29,331 | 33,998 | 3.0% |

| Spirits Market (000L) | 316,733 | 317,891 | 0.1% |

| Gin (£m) | 734 | 1,010 | 6.6% |

| Spirits Market (£m) | 9,727 | 10,966 | 2.4% |

Exports also grew substantially from £288m in 2010 to £394m in 2014, making the UK the world’s biggest exporter of gin.[12]

The WSTA estimate that the premium end of the gin market grew by 48.7% in the last two years,[13] a trend confirmed by the evolution of the UK gin market by quality category:[14]

| UK Gin Market % | 2009 | 2014 |

|---|---|---|

| Super Premium | 1.1 | 3.5 |

| Premium | 9.6 | 13.8 |

| Mid-priced | 43.0 | 44.0 |

| Economy | 46.2 | 38.8 |

The renaissance of gin in the UK is clearly concentrated at the top end of the market. It should also be remembered that gin has a relatively small share of the UK spirits market (9.4% compared to vodka at 30.3% and Scotch whisky at 18.8%),[15] and that gin exports are 1/10th those of Scotch whisky.[16]

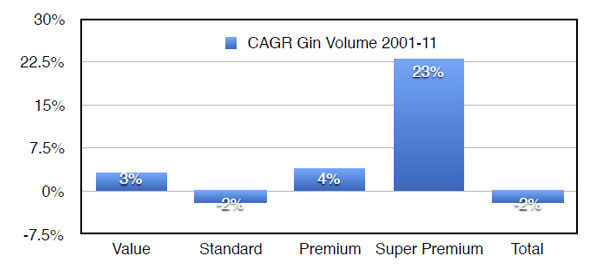

Globally, gin volumes have declined but value has grown. Gin accounts for 3% of the global spirits market by volume and 2% by value. Over the period 2003-2013, value grew at 2.1% CAGR compared to 6.1% for the total spirits market and 7.7% for the leader, cognac.[17] For the period 2001-11, gin volume fell by 2% annually but value increased by 3% annually.[18] Much of this poor performance is explained by the decline in Dutch gin sales in the Philippines but even global volumes of English gin sales declined c.1% CAGR from 2008-2013.[19]

The key trend driving global value growth is premiumisation:[20]

Indeed, in terms of value, the super-premium 10-year CAGR of 28% is ahead of vodka, scotch and cognac in the same quality category.[21]

This premium and above gin category is dominated by three markets – the USA, Spain and the UK. The trends in these markets and globally all show the premium category outperforming:[22]

| '000 9-liter cases | 2009 | 2013 | Premium+ Share | Premium+ CAGR | Gin Market CAGR |

|---|---|---|---|---|---|

| USA | 2,337.5 | 2,838.5 | 56% | 5.0% | -1.5% |

| UK | 354.5 | 562.5 | 11% | 12.2% | 1.5% |

| Spain | 170.8 | 460 | 9% | 28.1% | 4.2% |

| Canada | 156.8 | 228 | 4% | 9.8% | 1.7% |

| Germany | 42.8 | 127.5 | 3% | 31.4% | 5.0% |

| Others | 502.2 | 872.1 | 17% | 14.8% | |

| Total Premium Plus | 3,564.6 | 5,088.6 | 100% | 9.3% | |

| Global Gin Market | 49,499 | 46,952 | N/A | N/A | -1.3% |

The growth of the super-premium category has been driven primarily by smaller players, with brands emerging very rapidly from launch. Even gins made using the cold-compounding method have successfully positioned themselves in this category (e.g. Bathtub Gin reached UK sales of c.25,000 9L cases in 2014 after launch in 2011, one-third the sales of Hendrick’s).[23]

What sets many of these gins apart is experimentation with the choice of botanicals. Indeed, there are some gins where it is debatable whether or not juniper remains the dominant flavour. Recent examples include Portobello with an asparagus-flavoured gin,[24] and Edinburgh Gin with a Seaside Gin made with botanicals sourced from the local coastline such as seaweed and scurvy grass.[25] Leading brands are also releasing special recipe gins. Tanqueray has introduced a limited edition “Bloomsbury” gin based on a 19th century recipe from company archives,[26] while Beefeater has launched Burrough’s Reserve Gin, based on its original recipe from 1860.[27]

With the launch of so many new products, the market is becoming increasingly crowded, so gaining consumer recognition is key. The UK consumer is becoming more discerning: a recent survey by the Gin Guild claims that 6 out of 10 on-trade customers ask for a gin by brand name and 20% would pay more for a premium gin brand.[28] However, the same survey suggests that despite the influx of new brands, the most requested gins are still the established brands – Bombay Sapphire, Gordon’s, Beefeater and Tanqueray with Hendrick’s completing the top five (in 4th place).

Looking forward, Euromonitor expects the gin renaissance to continue and flourish further. In its most recent forecast, it predicts that consumption will grow globally over the period 2014-2019 by 11.1%, in Western European by 12.3% and in the UK by 18.4%.[29] This would require a significant about-turn in the trends seen over the past 10 years. Of the top 10 global markets, only Spain, UK, Travel Retail, Canada and Germany saw volume growth over the period 2009-2013.[30] How realistic then is this forecast?

In the UK, the market for premium gins is well-established and the continuing launch of new brands, together with the ongoing support of the on-trade and cocktail culture should continue to support growth. The success of London Cocktail Week in early October 2015 demonstrates that this is a trend that has not yet run out of steam.[31]

Spain has grown volumes despite the recession and, along with the US, continues to be the most important market for super-premium gin.[32] Although the US has seen overall volume declines, the super-premium sector continues to grow.[33] These two markets should see continued value growth, but volume growth may be more limited. There is evidence across Western Europe of an early interest in the top end of the market, but from a very low base.[34] Of the top 10 markets, Germany, Canada and Travel Retail all offer opportunities for growth, but again at the top end.[35] WSTA believes that there is significant export potential and rising demand in five of the leading international markets.[36]

However, given the heavy weighting of the Philippines and India in the overall global sales picture, both declining markets in recent years,[37] and despite the potential for continued value growth in the US and Western Europe, the global growth predictions by Euromonitor appear ambitious. The IWSR is more cautious, recently forecasting a gin/genever volume CAGR of -1.1% for 2013-19 compared to -1.4% for 2008-13.[38] Standard gins are forecast to continue to decline with premium plus gins expected to grow strongly.

This essay by Andrew de Csillery is made up of four parts:

- Introduction and the History of Gin from the Middle Ages to 1985

- Production of Gin, how process variations result in different flavours

- The revival of Gin over the past 30 years

- Conclusions and Commentary, how the category and market may develop over the next 10 years (including appendix and literature list)

[1] See Appendix 3 for tables of leading global brand volumes.

[2] Difford, Diffordsguide Gin Compendium, Pages 67-68.

[3] Difford, Diffordsguide Gin Compendium, Pages 68-71.

[4] Solmonson, Gin: A Global History, Page 118 and Williams, Gin Glorious Gin, Page 272.

[5] Mark Dawkins, co-founder of Langley’s No 8, identifies Hendrick’s and Bombay Sapphire as leading the renaissance of gin; he also cites the key role that the on-trade is playing (www.harpers.co.uk/news/analysis-and-insights/analysis-the-summer-of-gin/522873.article, last accessed 15/10/15).

[6] IWSR Magazine, September 2015, Page 15.

[7] Chase distillery in Herefordshire in 2008 and Sipsmith distillery in London in 2009 were the first to obtain licences for small stills (Sipsmith’s still can only hold 300L); Adnams in 2010 became the first brewer to obtain a distilling licence for the same site (Difford, Diffordsguide Gin Compendium, Page 74).

[8] DEFRA, cited in www.just-drinks.com/analysis/how-to-market-uk-gin-to-the-rest-of-the-world-analysis_id117796.aspx, last accessed 27/10/2015 and www.gov.uk/government/news/gin-exports-set-to-increase-as-drink-experiences-uk-revival, last accessed 28/10/2015.

[9] IWSR, sourced from the Gin & Vodka Association.

[10] WSTA, cited in www.drinksint.com/news/printpage.php/aid/5432/WSTA_celebrates_World_Gin_Day_.html, last accessed 15/10/15.

[11] Spirits in the UK, Passport, June 2015, Tables 1 and 2.

[12] www.thespiritsbusiness.com/2015/06/uk-gin-exports-hit-record-breaking-high/ and www.thedrinksbusiness.com/2015/08/uk-worlds-biggest-exporter-of-gin/, both last accessed 28/10/15.

[13] www.thedrinksbusiness.com/2015/06/trade-moves-to-build-on-british-gin-success/, last accessed 19/10/15

[14] Spirits in the UK, Passport, June 2015, Table 13.

[15] WSTA Market Overview, 2015 Edition, Page 26.

[16] 139m bottles in 2013 compared to 1.2Bn for Scotch whisky (WSTA Market Overview, 2015 Edition, Page 12); £394m value in 2014 compared to £4Bn for whisky (https://www.gov.uk/government/news/gin-exports-set-to-increase-as-drink-experiences-uk-revival, last accessed 28/10/15).

[17] Stirling, Trevor et al, The Bernstein Global Spirits Guide, Page 7.

[18] Stirling, Trevor, Gin: a tortuous history with a brilliant future?, Page 7.

[19] White Spirits: Difficult Times but Opportunities Lie Ahead, Passport/Euromonitor International, Page 23.

[20] Stirling, Trevor, Gin: a tortuous history with a brilliant future?, Page 10.

[21] idem, Page 11.

[22] Analysis of IWSR Magazine, February 2015, Page 23 and IWSR Data from Gin & Vodka Association.

[23] Stirling, Trevor et al, Consumer Blast: Could Craft Spirits One Day Be As Big As Craft Beer? We think not, Page 3.

[24] www.thedrinksreport.com/news/2015/16206-london-dry-gin-distilled-with-asparagus.html, last accessed 28/10/15.

[25] www.just-drinks.com/news/product-launch-spencerfield-spirits-cos-seaside-gin_id117236.aspx, last accessed 28/10/15.

[26] www.harpers.co.uk/news/tanqueray-looks-to-the-past-to-inspire-limited-edition-bloomsbury-gin-launch/524705.article, last accessed 28/10/15.

[27] www.thespiritsbusiness.com/2013/04/new-beefeater-burroughs-reserve-to-redefine-gin-drinking/, last accessed 28/10/15.

[28] www.theginguild.com/news/46/57/New-research-reveals-G-T-is-officially-the-spirit-based-drink-of-choice-for-summer, last accessed 28/10/15.

[29] www.harpers.co.uk/news/analysis-and-insights/analysis-the-summer-of-gin/522873.article, seen 15/10/15.

[30] Global Gin Insights, just-drinks/IWSR, Page 4.

[31] Compared to 2014, wristband wearers increased by 31.5% and tickets sold by 25%. 40,000 visited the London Cocktail Week Village (London Cocktail Week 2015, Post Event Evaluation, DrinkUpLdn).

[32] Global Gin Insights, just-drinks/IWSR, Pages 20-23 and IWSR Magazine, September 2015, Pages 25-26.

[33] Global Gin Insights, just-drinks/IWSR, Pages 57-60 and IWSR Magazine, November 2014, Pages 12-14.

[34] IWSR Magazine, July 2015, Page 18.

[35] Global Gin Insights, just-drinks/IWSR, Page 6 and also IWSR Magazine, February 2015, Page 23.

[36] www.harpers.co.uk/news/gin-producers-eye-up-european-growth/519672.article, last accessed 28/10/15.

[37] See Appendix 1.

[38] IWSR Magazine, December 2014/January 2015, Page 12.